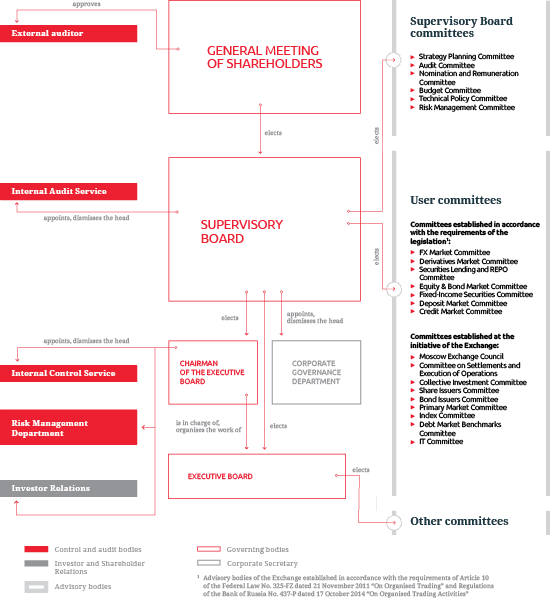

Corporate governance

Corporate governance system

CORPORATE GOVERNANCE MODEL AND PRACTICE

Moscow Exchange is one of Russia’s largest public companies. The Bank of Russia, which acts as regulator of the financial market, is one of the Exchange’s shareholders. The Exchange is also a market infrastructure operator that establishes rules for other issuers. Because of all these factors, the Exchange must adhere to the highest corporate governance standards. Continued development of the corporate governance system is aimed primarily at improving MOEX’s effectiveness and competitiveness, and maintaining a positive perception of the Exchange’s corporate governance system among shareholders, investors and the broader business community.

The Exchange continuously evaluates and responds to developments in corporate legislation and corporate governance practices in Russia and internationally. It complies with the Federal Law on Organized Trading (No. 325-FZ dated 21 November 2011), which outlines the corporate governance requirements for the organizer of trading; the principles and recommendations prescribed in the Corporate Governance Code of the Bank of Russia; the requirements of the Listing Rules; the G20/OECD corporate governance principles; international standards and principles relating to corporate social responsibility and sustainable development; as well as the disclosure standards developed by the Global Reporting Initiative (GRI).

Shares of Moscow Exchange are traded on the Exchange’s own platform and included in the first level quotation list. To ensure that the Exchange’s activities and documents fully comply with the corporate governance requirements set out in the Listing Rules and with the Bank of Russia’s Corporate Governance Code, the following measures were taken in 2020:

- eight independent directors were elected to the Supervisory Board, which consists of 12 members;

- all independent directors meet the independence criteria set by the Listing Rules;

- An independent director was elected as Chairman of the Supervisory Board;

- the Audit Committee and the Nomination and Remuneration Committee consist only of independent members of the Supervisory Board.

GENERAL MEETING OF SHAREHOLDERS

The General Meeting of Shareholders is the supreme governing body of Moscow Exchange. General Meetings of Shareholders adopt resolutions on strategic issues. The scope of issues within the terms of reference of General Meetings of Shareholders is determined by the Federal Law on Joint-Stock Companies (No. 208-FZ dated 26 December 1995) and Moscow Exchange Charter.

The Annual General Meeting of Shareholders (AGM) of Moscow Exchange was held on 28 April 2020. In addition to reviewing mandatory and routine issues, the AGM voted for resolutions on approval of new versions of the Charter, Provisions on the Procedure of Preparation, Convocation and Holding of the General Shareholders Meeting as well as Provisions on the Supervisory Board.

Under paragraph 1, Article 85 of Federal Law on Joint-Stock Companies, a revision commission is not required to be established in a joint-stock company if the commission is not set out in the company’s charter. Therefore, a new version of the Charter of Moscow Exchange without the Revision Commission set out therein was submitted for consideration by the AGM. As the AGM approved the new version of the Charter, the results of voting on the item regarding the election of members of the Revisions Commission were not finalized, the Revision Commission is deemed as having not been established and members of the Commission are deemed as having not been elected.

SUPERVISORY BOARD

Role of the Supervisory Board

The Supervisory Board is a key element of the corporate governance system, with overall responsibility for the activities of Moscow Exchange.

The Supervisory Board is accountable to the General Meeting of Shareholders: members of the Supervisory Board are elected by the General Meeting of Shareholders, and their powers may be terminated at any time by the General Meeting of Shareholders.

The terms of reference of the Supervisory Board are established in the Charter and are clearly separated from those of the executive bodies that manage the day-to-day activities of the Exchange. The Supervisory Board:

- determines the vision, mission and strategy of the Exchange;

- is responsible for strategic oversight of the Exchange and long-term sustainable development;

- establishes strategic goals and key performance indicators.

When developing Moscow Exchange’s strategy, the Supervisory Board takes into account shareholders’ vision for the development of the Exchange. The Supervisory Board considers queries and requests from shareholders and investors and, if necessary, gives appropriate instructions to senior management.

The work schedule approved by the Supervisory Board includes the main activities of the Exchange, which are correlated with the strategic planning cycle and ongoing business cycles. When preparing the work schedule, proposals of members of the Supervisory Board and senior executives on priority issues are taken into account.

Information on the activities of the Supervisory Board, including its composition, meetings held and work of its committees, is disclosed on the Exchange’s website in the form of press releases and corporate action notices, as well as the Annual Report, which ensures transparency of the activities of the Supervisory Board.

Structure of the Supervisory Board

The Supervisory Board is composed of directors who have the experience and professional skills required to oversee implementation of the Exchange’s strategy.

In accordance with the Exchange’s Charter, the number of members of the Supervisory Board is set by the resolution of the General Meeting of Shareholders.

Currently, the Supervisory Board of Moscow Exchange is comprised of 12 members.

The Supervisory Board is managed and administered by the Chairman of the Supervisory Board.

The Chairman is elected/re-elected by the members of the Supervisory Board from among the Board membership, by a majority vote.

The following committees were formed by the Supervisory Board for preliminary consideration of key issues and preparation of recommendations for the Supervisory Board:

- Strategy Planning Committee;

- Audit Committee;

- Nomination and Remuneration Committee;

- Technical Policy Committee;

- Risk Management Committee.

Members of the committees are selected annually from among the members of the Supervisory Board. Four of the five Supervisory Board Committees are headed by independent directors; the Audit Committee and the Nomination and Remuneration Committee are composed only of independent directors. Non-Board member IT experts are also invited to participate in the Technical Policy Committee.

The Supervisory Board is comprised of members who have the experience and professional skills required to oversee implementation of the Exchange’s strategy. Members of the Supervisory Board of the Exchange are experts in financial market infrastructure, international organized trading, IT in the financial sector, operational and financial risk management and financial reporting. They also have skills in personnel policy and modern approaches to incentivizing top managers.

Following the election at the 2020 Annual General Meeting of Shareholders, the Supervisory Board included seven independent directors who met all the independence criteria set forth in the Listing Rules (no relationship with the Exchange, its significant shareholders, significant competitors, or counterparties, as well as no relationship with the government), and five non-executive directors. At the first meeting, one additional director was qualified as independent director, notwithstanding existing formal relationship with counterparties. Oleg Viyugin is also a member of the Board of Directors of the National Association of Securities Market Participants (NAUFOR), for which the Exchange is a significant counterparty. In late September, the Supervisory Board decided to qualify Paul Bodart as an independent director notwithstanding possible formal relationship with a significant counterparty of the Exchange as Paul Bodart is also a member of the Supervisory Board of NSD.

There are no conflicts of interests of Supervisory Board members and Executive Board members (including those relating to the participation of the said persons in the governing bodies of the Exchange’s competitors)

Composition of the Supervisory Board

No | Composition of the Supervisory Board as elected from 25 April 2019 (Minutes No. 59 as of 25 April 2019) | No | Composition of the Supervisory Board as elected from 28 April 2020 (Minutes No. 61 as of 28 April 2020) |

|---|---|---|---|

Independent directors | |||

1 | Rainer RIESS | 1 | Ramón ADARRAGA |

2 | Maria GORDON | 2 | Maria GORDON |

3 | Oleg VIYUGIN | 3 | Oleg VIYUGIN |

4 | Alexander IZOSIMOV | 4 | Alexander IZOSIMOV |

5 | Mikhail BRATANOV | 5 | Maxim KRASNYKH |

6 | Paul BODART | 6 | Paul BODART |

7 | Dmitry EREMEEV | 7 | Dmitry EREMEEV |

8 | Oskar HARTMANN | ||

Non-executive directors | |||

8 | Andrey GOLIKOV | 9 | Andrey GOLIKOV |

9 | Valery GOREGLYAD | 10 | Valery GOREGLYAD |

10 | Bella ZLATKIS | 11 | Bella ZLATKIS |

11 | Ilya BAKHTURIN | 12 | Vadim KULIK |

Executive director (from 16 May 2019) | |||

12 | Yury DENISOV | ||

Information on the Supervisory Board members elected at the Annual General Meeting of Shareholders held on 28 April 2020

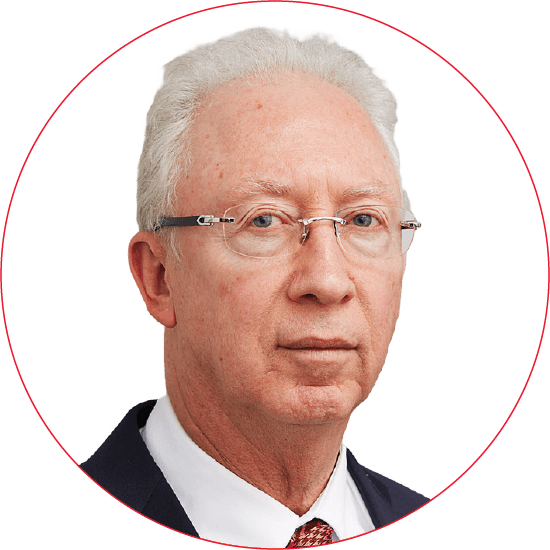

Chairman of the Supervisory Board, Independent Director

Member of the Strategic Planning Committee, member of the Nomination and Remuneration Committee.

Born on 29 July 1952 in Ufa.

- In 1974, he graduated from the Lomonosov Moscow State University with a qualification in Mathematics.

- He holds a PhD in Physics and Mathematics. He is a professor in the Finance Department at the Higher School of Economics.

- Since 2007, he has been a professor of the School of Finance of the Economic Science Department at the HSE University. Since 2019, he has been an Adviser to the Director General of SAFMAR Financial Investment. He is a member of the Council of the Strategic Development Center and AGAT Youth Entrepreneurship Fund. He is Chairman of the Board of Directors of NAUFOR and SAFMAR Financial Investment; a member of the Board of Directors of Rosneft, Unipro and SF Holdings Company Plc; a member of the Presidium of the National Council on Corporate Governance.

- He was first elected to Moscow Exchange’s Supervisory Board on 27 April 2017.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board, Independent Director

Member of the Strategic Planning Committee, member of the Audit Committee.

Born on 7 October 1963 in Madrid.

- In 1986, he graduated from the Universidad Pontificia Comillas (ICADE, Madrid, Spain), with a degree in Economic Sciences and Business Administration.

- Currently, an independent consultant.

- From 2003 to 2019, he was a member of the Top Management Committee of

BME – Spanish Exchanges: - Director of the International Affairs Division

- Director of the Market Data & Value-Added Services Business Unit

- From 1995 to 2019, he was Secretary General

(1995–2005) and Board member(2005–2019) at European Capital Market Institute. - From 2004 to 2016, he was CEO at Infobolsa, S.A.

- From 2008 to 2014, he was a member of the Board of the Spanish Institute of Financial Analysts (IEAF).

- From 1994 to 2003, he was Head of International Affairs of Madrid Stock Exchange.

- He was first elected to Moscow Exchange’s Supervisory Board on 28 April 2020.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

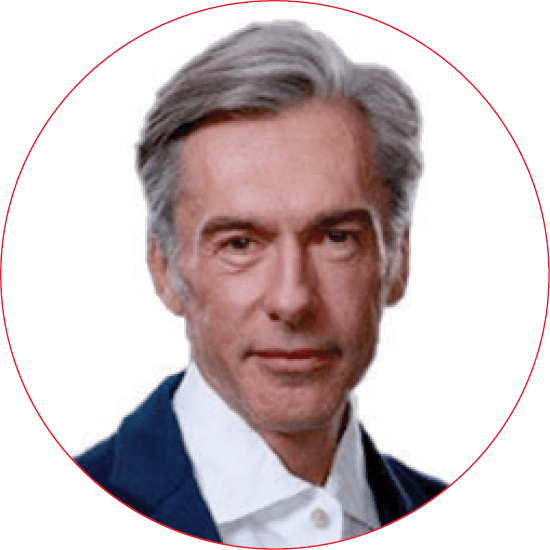

Member of the Supervisory Board, Independent Director

Member of the Strategy Planning Committee, member of the Audit Committee.

Born on 22 January 1953 in Rotterdam.

- In 1976, he graduated from the Universite Catholique de Louvain (Belgium) with a Master’s degree in Applied Engineering Mathematics.

- In 1986, he graduated from INSEAD business school (Fontainebleau, France) with an MBA degree.

- From 2013 to 2019, he was a professor at Solvay Brussels School (post-degree program in financial markets).

- From 2012 to 2015, he was a non-central bank member of the T2S Board (the European Central Bank), and from 2013 to 2016, he was an independent director of Dexia SA.

- Currently, he is a member of the Supervisory Board of NSD, independent director of Belfius Bank S.A. and member of the General Council of Hellenic Financial Stability Fund (HFSF).

- He was elected to Moscow Exchange’s Supervisory Board on 25 April 2019.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Deputy Chairman of the Supervisory Board

Chairman of the Risk Management Committee, and member of the Strategic Planning Committee.

Born on 14 March 1969 in Volzhsky, Volgograd region.

- In 1991, he graduated from the Lomonosov Moscow State University with a degree in Mechanics.

- In 2016, he received a Diploma in Company Direction from the Institute of Directors (IoD).

- He is an independent director of the Supervisory Board of Russian National Reinsurance Company, a member of the Boards of Directors of Otkritie Bank and Absolut Bank, a member of the Supervisory Board of CCP NCC, and co-Chairman of the Board of Directors of NFA.

- He was first elected to Moscow Exchange’s Supervisory Board on 24 April 2003.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

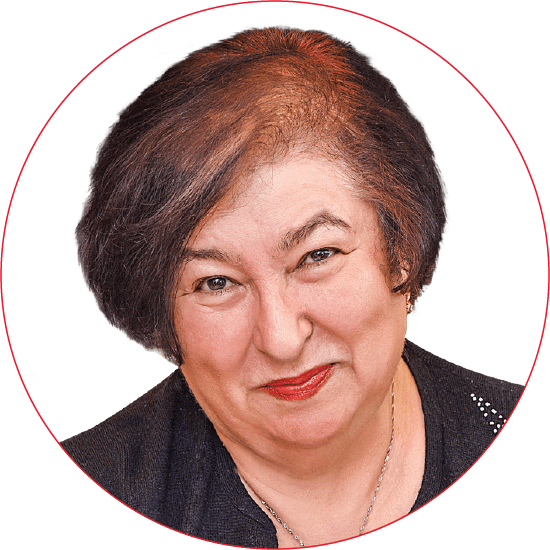

Member of the Supervisory Board, Independent Director

Chairman of the Audit Committee and member of the Nomination and Remuneration Committee.

Born on 13 February 1974 in Vladikavkaz.

- In 1995, she graduated from the University of Wisconsin (USA) with a Bachelor’s degree in Political Science.

- In 1998, she graduated from the Fletcher School of Law and Diplomacy at Tufts University with a Master of Arts degree.

- She is a member of the Supervisory Boards of ALROSA, Polyus and Detsky Mir.

- She was first elected to Moscow Exchange’s Supervisory Board on 27 April 2016.

She has no interest in the share capital of Moscow Exchange. She reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board

Member of the Risk Management Committee.

Born on 18 June 1958 in Glusk, Glusk district, Mogilev region.

- In 1981, he graduated from the Ordzhonikidze Moscow Aviation Institute with a Mechanical Engineering qualification (Aircraft Production).

- In 2017, he graduated from the Russian Presidential Academy of National Economy and Public Administration with a degree in Jurisprudence.

- He holds a PhD in Economics. Since 2009, he has been a professor at the Higher School of State Audit at Lomonosov Moscow State University.

- Since 2013, he has been the Chief Auditor of the Bank of Russia.

- He is a member of the Board of Directors of Rosgosstrakh; a member of the Supervisory Board of Russian National Reinsurance Company; a member of the Supervisory Board of the Russian Union for Collection (ROSINKAS); as well as a member of the Council of Institute of Internal Auditors Association.

- He was first elected to Moscow Exchange’s Supervisory Board on 26 June 2014.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board, Independent Director

Member of the Strategic Planning Committee, member of the Technical Policy Committee.

Born on 26 May 1983 in Kazan.

- In 2005, he graduated from Kazan State University with a qualification in Applied Mathematics and IT.

- From 2013 to 2016, he was a Senior Expert Advisor to the Head of Kazan Municipal Entity Office of the Secretariat of the Kazan City Duma. Currently, he is the Chairman of the Board of Directors of Bank 131.

- He was elected to Moscow Exchange’s Supervisory Board on 25 April 2019.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board

Born on 5 July 1948 in Moscow.

- In 1970, she graduated from the Moscow Finance Institute with a qualification in Finance and Credit.

- She has a PhD in Economics.

- Since 2004, she has been the Deputy Chair of the Executive Board at Sberbank. Earlier, she worked in the Ministry of Finance of the Russian Federation for more than 30 years.

- Since 2011, she has been a member of the Supervisory Board of NSD and is currently its Chairwoman. Ms. Zlatkis is a member of the Supervisory Board of Sberbank.

- She was first elected to Moscow Exchange’s Supervisory Board on 19 May 2011.

She has no interest in the share capital of Moscow Exchange. She reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board, Independent Director

Chairman of the Nomination and Remuneration Committee, Member of the Audit Committee.

Born on 10 January 1964 in Yakutsk.

- In 1987, he graduated from the Moscow Aviation Institute with a qualification in System Engineering.

- From 2003 to 2011, he was the CEO of VimpelCom.

- During the period from 1996 to 2003, he worked in Mars Inc., and from 2001 to 2003 held the position of its President in CIS Countries, Central Europe and Scandinavia.

- Earlier in his career he worked at the international consultancy McKinsey & Company.

- Since 2012, he has been CEO of DRC Advisors AB.

- Since 1 October 2020, he has been the CEO and member of the Executive Board of M.Video. Currently, he is a member of the Boards of Directors of DRCAdvisors AB, EVRAZ plc., Nilar AB and Hövding AB.

- He was first elected to Moscow Exchange’s Supervisory Board on 26 April 2018.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board, Independent Director

Member of the Strategic Planning Committee, member of the Nomination and Remuneration Committee, member of the Technical Policy Committee

Born on 9 September 1982 in Yoshkar-Ola, Mari ASSR.

- In 2004, he graduated from the Financial University under the Government of the Russian Federation, Master in Finance.

- In 2014, he graduated from Columbia University, MBA.

- Since 2015, COO at Gett representing management in the company’s Board of Directors.

- Worked in corporate finance (PwC) and the investment sector (Intel Capital, Alfa Capital Partners, Fleming Family and Partners), where he was responsible for investments and development of technological companies, including marketplaces, and companies dealing with the voice recognition, cloud communications and logistics.

- Currently, he is a member of the Board of Directors at GT Gettaxi Systems IL.

- He was first elected to Moscow Exchange’s Supervisory Board on 28 April 2020.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board

Chairman of the Technical Policy Committee, member of the Risk Management Committee

Born on 14 August 1972 in Nalchik, the Kabardino-Balkarian Republic.

- In 1996, he graduated from the D. Mendeleev University of Chemical Technology of Russia, with degree in Chemical Technology of Modern Energetics Materials.

- In 1998, he graduated from Plekhanov Russian Academy of Economics, with degree in Finance and Credit.

- He worked at Sberbank for 6 years, became the Deputy Chair of the Executive Board. Was in charge of risk management, information and technical services and operations. Was a member of the Executive Board of Sberbank.

- From 2017 to 2020, he worked at Gazprom as the Deputy Chair of the Executive Board.

- Since 2019, he served as Deputy

President – Chair of the Executive Board of VTB Bank, and since 2017, Director of the Digital Competence Centre at the Russian Presidential Academy of National Economy and Public Administration. - Since 2017, he has been a member of the Supervisory Board at Russian National Reinsurance Company, a member of the Supervisory Board of CCP NCC.

- He was first elected to Moscow Exchange’s Supervisory Board on 28 April 2020.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board, Independent Director

Member of the Strategic Planning Committee, member of the Technical Policy Committee

Born on 14 May 1982 in Jambyl, Kazakhstan

- In 2008, he graduated from the WHU - Otto Beisheim School of Management (Germany), international management.

- Since 2010, he has been founder and president at Hartmann Holdings.

- Since 2012, he has been president of the Charitable Foundation to support and develop the Russian economy.

- Since 2015, he has been founder and president at Aktivo.

- Since 2017, he has been founder and CEO at Polyanka OOO.

- Since 2013, he has been co-founder and chairman of the board of directors at CarPrice.

- Since 2017, he has been a member of the board of directors at Alfa Bank.

- He was first elected to Moscow Exchange’s Supervisory Board on 28 April 2020.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Information on the Supervisory Board members before 28 April 2020

Member of the Supervisory Board

Member of the Strategy Planning Committee.

Born on 3 January 1978 in Moscow, Russia.

- In 2000, he graduated from the Lomonosov Moscow State University with a Bachelor’s degree in Economics.

- From 2016 to 2017, he was an Executive Director at Goldman Sachs (Russia) and held a post at Baring Vostok Capital Partners Group Limited.

- From 2017 to 2019, he was Special Investment Project Director at the Russian Direct Investment Fund.

- Currently, he holds the position of Investment Director at Complexprom Joint-Stock Company.

- He was elected to Moscow Exchange’s Supervisory Board on 25 April 2019.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board, Independent Director

Chairman of the Nomination and Remuneration Committee, member of the Budget Committee, member of the Risk Management Committee.

Born on 16 May 1973 in Dolgoprudny, Moscow region.

- In 1996, he graduated from the Moscow State Institute of Electronic Engineering with degrees in Electronic Engineering and Management.

- In 2011, he graduated from the Moscow School of Management SKOLKOVO with an Executive MBA degree.

- In 2017, he received a Chartered Director qualification from the Institute of Directors (IoD).

- In 2019, he graduated from the Centre for Effective Dispute Resolution, UK with Accredited CERD Mediator qualification.

- He holds a PhD in Economics.

- Since 2007, he has been the Director of the Securities Services Department and Head of Societe Generale Securities Services in Russia and CIS at ROSBANK.

- He is a member of the Supervisory Board of NSD; a member of the Boards of Directors of the Professional Association of Transfer-Agents, Registrars and Depositories (PARTAD), RB Specialised Depository, Russian National Reinsurance Company, and National Financial Association. He is also a Chairman of the Executive Board of the Association of Landowners on Assistance in Pestovo Villa Community Improvement.

- He was first elected to Moscow Exchange’s Supervisory Board on 19 May 2011.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Member of the Supervisory Board

Born on 31 May 1970 in Moscow.

- In 1993, he graduated from the Moscow State Institute of International Relations with a qualification in International Economic Relations.

- Since 2019, he has been Chairman of Moscow Exchange Executive Board.

- He is a member of the Supervisory Boards of CCP NCC and NSD, as well as a member of the Executive Board of the Russian Union of Industrialists and Entrepreneurs.

- He was first elected to Moscow Exchange’s Supervisory Board on 24 April 2008.

He has no interest in the share capital of Moscow Exchange.

He reported the following transactions involving shares of Moscow Exchange in 2020.

Date | Purchase (in shares) | Sale (in shares) | Balance | Equity interest, % |

|---|---|---|---|---|

06 November 2020 | 611,444 | 611,444 | 0.0268 | |

13 November 2020 | 250,000 | 361,444 | 0.0159 | |

16 November 2020 | 361,444 | 0 | 0 |

member of the Supervisory Board, Independent Director

Chairman of the Strategy Planning Committee, member of the Audit Committee.

Born on 20 January 1966 in Darmstadt, Germany.

- In 1993, he graduated from the University of Miami with an MBA degree (Finance, Marketing).

- In 1994, he graduated from the Wolfgang Goethe University (Frankfurt) with a Master of Arts degree in Economics.

- He is the Managing Partner and owner of Addwis GmbH (Frankfurt, Germany) and RR Little Paradise Real Estate LLC, as well as the General Director of the Federation of European Securities Exchanges AISBL (FESE).

- He was first elected to Moscow Exchange’s Supervisory Board on 25 June 2013.

He has no interest in the share capital of Moscow Exchange. He reported no transactions involving shares of Moscow Exchange in 2020.

Activities of the Supervisory Board in 2020

From 1 January 2020 to 31 December 2020, the Supervisory Board held 24 meetings (including five in-person meetings).

Seven meetings of the Supervisory Board were held prior to and 17 meetings after the Annual General Meeting of Shareholders on 28 April 2020.

Full name | Number of meetings attended | % of meetings attended |

|---|---|---|

Ramón ADARRAGA (member of the Supervisory Board since 28 April 2020) | 17 | 100 |

Ilya BAKHTURIN (member of the Supervisory Board until 28 April 2020) | 7 | 100 |

Paul BODART | 24 | 100 |

Mikhail BRATANOV (member of the Supervisory Board until 28 April 2020) | 7 | 100 |

Oleg VIYUGIN | 24 | 100 |

Andrey GOLIKOV | 24 | 100 |

Maria GORDON | 24 | 100 |

Valery GOREGLYAD | 23 | 95.8 |

Yury DENISOV (member of the Supervisory Board until 28 April 2020) | 7 | 100 |

Dmitry EREMEEV | 24 | 100 |

Bella ZLATKIS | 24 | 100 |

Alexander IZOSIMOV | 23 | 95.8 |

Maxim KRASNYKH (member of the Supervisory Board since 28 April 2020) | 17 | 100 |

Vadim KULIK (member of the Supervisory Board since 28 April 2020) | 17 | 100 |

Rainer RIESS (member of the Supervisory Board until 28 April 2020) | 7 | 100 |

Oskar HARTMANN (member of the Supervisory Board since 28 April 2020) | 12 | 70.6 |

Many issues on the agenda of Supervisory Board meetings are considered ahead of time by the relevant committees to allow for a more detailed discussion and to give voting recommendations to the Supervisory Board.

In 2020, the Supervisory Board considered issues relating to the performance of its main functions, including:

- strategy issues:

- approval of the internal audit strategy of the Moscow Exchange Group;

- approval of the IT strategy of Moscow Exchange through 2024;

- approval of the risk management strategy of the Moscow Exchange Group through 2024;

- approval of the information security strategy of the Moscow Exchange Group through 2024;

- personnel issues:

- approval of the decision to increase the number of members in the Executive Board and elect two new members of the Board;

- preparation of recommendations to shareholders with regard to the membership of the Exchange’s Supervisory Board for election at the Annual General Meeting of Shareholders;

- business development issues:

- review of fees on the Equity and Bond Market, deposit market and Derivatives Market; trading fees on the FX Market, and listing fees; approval of an update to the Regulations on Fees for Participation in Trading on the Equity and Bond Market and Deposit Market;

- key documents of the Exchange:

- Rules of the organized trading on the Exchange’s markets, Listing Rules;

- Rules of admission to organized trading on all markets;

- risk management issues:

- approval of risk-appetite indicators for the Group and their ranges for

2021–2024 ; - approval of an updated method for defining benchmark indices of risk appetite for the Exchange;

- approval of the rules on management of risks related to financial platform operator activities.

- approval of risk-appetite indicators for the Group and their ranges for

Appointment, induction and training of Supervisory Board members

In accordance with the Federal Law on Joint Stock Companies and the Exchange’s Charter, shareholders holding in aggregate at least 2% of the voting shares in Moscow Exchange may nominate candidates to the Supervisory Board of the Exchange (the number of which cannot exceed the number of members of the Supervisory Board of the Exchange) no later than 60 days after the end of each fiscal year.

As of 2 March 2020, the Exchange had received proposals for the nomination of three candidates to the Supervisory Board to be elected at the Annual General Meeting of Shareholders in 2020; all three were included in the list for voting at the General Meeting of Shareholders.

In accordance with the amendments to the Federal Law on Joint Stock Companies, the Supervisory Board is entitled to nominate candidates for the Exchange’s Supervisory Board (apart from those nominated by the shareholders) at its own discretion. Succession planning and provision for the required competencies on the Supervisory Board are considered to be best practice. The Nomination and Remuneration Committee, taking into account consultations with the members of the Supervisory Board and significant shareholders, recommended that the Supervisory Board include 12 candidates most suitable for election to the Supervisory Board for the

As part of the introduction of newly elected directors, an onboarding program for new Board members is being implemented, which provides for familiarization with the main internal documents of the Exchange, resolutions of the meeting of shareholders and the Supervisory Board, as well as for holding individual meetings with the Chairman of the Supervisory Board, Chairman of the Executive Board, corporate secretary and key managers of the Group.

ACTIVITIES OF THE SUPERVISORY BOARD COMMITTEES

Over the period | Over the period | Total in 2020 | |||

|---|---|---|---|---|---|

in-person | remote | in-person | remote | ||

Strategy Planning Committee | 2 | 2 | 4 | - | 8 |

Audit Committee | 2 | 1 | 4 | 3 | 10 |

Nomination and Remuneration Committee | 6 | 1 | 4 | 2 | 13 |

Budget Committee | 1 | 5 | - | - | 6 |

Risk Management Committee | 3 | - | 7 | 2 | 12 |

Technical Policy Committee | 1 | - | 4 | - | 5 |

Full name | Strategy Planning Committee | Audit Committee | Nomination and Remuneration Committee | Budget Committee | Risk Management Committees | Technical Policy Committees |

|---|---|---|---|---|---|---|

Ramón ADARRAGA | 100% | 100% | ||||

Ilya BAKHTURIN (member of the committee until 28 April 2020) | 75% | |||||

Paul BODART | 100% | 100% | ||||

Mikhail BRATANOV (member of the committee until 28 April 2020) | 100% | 100% | 100% | |||

Oleg VIYUGIN | 100% | 92% | ||||

Andrey GOLIKOV | 100% | 100% | 100% | |||

Maria GORDON | 100% | 100% | 100% | |||

Valery GOREGLYAD | 100% | |||||

Dmitry EREMEEV | 88% | 60% | ||||

Alexander IZOSIMOV | 80% | 100% | 100% | |||

Maxim KRASNYKH | 100% | 83% | 75% | |||

Vadim KULIK | 100% | 100% | ||||

Rainer RIESS (member of the committee until 28 April 2020) | 100% | 67% | ||||

Oscar HARTMANN | 100% | 75% |

Audit Committee

The primary purpose of the Audit Committee is to ensure the Supervisory Board is effective in addressing issues relating to the control of financial and economic activities.

Composition of the Committee:

- Maria Gordon, Chairman of the Committee;

- Members of the Committee: Ramón Adarraga, Paul Bodart, Alexander Izosimov.

71 issues were considered at meetings of the Audit Committee in 2020.

The main issues considered by the Committee in 2020 and on which recommendations were given to the Supervisory Board related to the assessment of the performance of the Group’s external auditor, review of the consolidated financial statements and reports of the Internal Audit Service.

The Audit Committee reviewed issues related to abolition of the Revision Committee, results of the assessment of a compliance culture, a roadmap to embed a compliance culture across the Group, the Group’s internal audit development strategy, as well as assessment of the maturity of information security in the Group.

The Committee gave an assessment of MOEX’s existing risk management system, which resulted in recommendations to refine the material submitted for assessment based on the results of the internal information security audit, remediation plans and to resubmit it to the Audit Committee and the Supervisory Board in 2021.

The Committee recommended that the Supervisory Board approve the Business Ethics Code and Anti-Corruption Policy.

In 2020, the Supervisory Board recommended that the General Meeting of Shareholders select ZAO Deloitte & Touche CIS as external auditor upon the recommendation of the Audit Committee and the corresponding decision was made at the Annual General Meeting.

Additionally, the Committee gave recommendations to the Supervisory Board on increasing the number of full-time employees in the Internal Audit Service and approval the updated Internal Audit Service Provisions, awarding the head and employees of the Internal Audit Service of the Exchange based on their performance in 2019.

Nomination and Remuneration Committee

The primary purpose of the Nomination and Remuneration Committee is to support the effective work of the Supervisory Board in addressing issues relating to the activities of the Exchange as well as other companies directly or indirectly controlled by the Exchange, and the nomination and remuneration of members of supervisory boards, executive bodies and other key executives and members of revision commissions.

Composition of the Committee:

- Alexander Izosimov, Chairman of the Committee;

- Members of the Committee: Oleg Viyugin, Maria Gordon, Maxim Krasnykh.

50 issues were considered by the Nomination and Remuneration Committee of the Supervisory Board in 2020.

The main issues considered by the Committee in 2019 and on which relevant recommendations were given to the Supervisory Board related to planning of compositions of supervisory boards of the Exchange, NSD, and CPP NCC, assessment of the independence of candidates and members of the Supervisory Board of the Exchange, training of members of the Supervisory Board of the Exchange, nomination of candidates for the Supervisory Board, giving recommendations on the determination and assessment of achievement of corporate KPIs of the Group and individual KPIs of members of executive bodies and the Director of the Corporate Governance Department of the Exchange, the option program for management, management succession program and early termination or extension of powers of members of the Executive Board as well as selection of new members of the Executive Board.

Strategy Planning Committee

The primary purpose of the Strategy Planning Committee is to improve the performance of the Exchange and its subsidiaries and affiliates as well as companies directly or indirectly controlled by the Exchange in the long and medium term.

Composition of the Committee:

- Paul Bodart, Chairman of the Committee;

- Members of the Committee: Ramón Adarraga, Oleg Viyugin, Andrey Golikov, Dmitry Eremeev, Maxim Krasnykh, Oscar Hartmann.

27 issues were considered at the meetings of the Strategy Planning Committee of the Supervisory Board in 2020.

The main issues considered by the Committee in 2020 and on which recommendations were given to the Supervisory Board related to further development of the business through the acquisition of a FX platform, approval of the risk management strategy and a plan to correct the 2024 Strategy, the reasonableness of the flexible business planning over the three-year horizon as well as selection of initiatives to be added to 2021 KPIs of Moscow Exchange Group companies.

Risk Management Committee

The main task of the Risk Management Committee is to foster the improvement of the risk management system of the Exchange and Group companies in order to enhance the reliability and efficiency of the activities of the Exchange.

Composition of the Committee:

- Andrey Golikov, Chairman of the Committee;

- Members of the Committee: Valery Goreglyad, Vadim Kulik.

50 issues were considered by the Risk Management Committee of the Supervisory Board in 2020.

The main issues considered by the Committee in 2020 and on which relevant recommendations were given to the Supervisory Board related to the regular analysis of the Group’s reports on management of various risks, including business continuity, operational, non-financial, uneconomic and other risks. At the meetings of the Committee, special attention was paid to improvement of operational risk management, improvement of performance criteria of the risk management system and adoption of the risk appetite indicators.

Budget Committee

The primary purpose of the Budget Committee is to support the Supervisory Board of the Exchange in exercising control over the formation and expenditure of funds intended for financial support of the Exchange and the Group companies.

According to the decision made by the Supervisory Board on 29 April 2020, the Budget Committee was abolished.

Composition of the Committee:

- Andrey Golikov, Chairman of the Committee.

- Members of the Committee: Mikhail Bratanov, Maria Gordon.

10 issues had been considered by the Budget Committee in 2020 before it was liquidated.

The main issues considered by the Committee in 2020 and on which relevant recommendations were given to the Supervisory Board related to planning of the consolidated budget and control over its execution, determination of the amount of dividends in accordance with the dividend policy including dividends of Exchange subsidiaries, setting fees for deposit transactions with the central counterparty as well as the marketing program for a new IT service.

Technical Policy Committee

The main objectives of the Technical Policy Committee are the development and strengthening of effectiveness of the Group’s activities through preparation of recommendations and expert opinions to the Supervisory Board, boards of directors (supervisory boards) of Group companies and their committees and executive bodies of the Exchange and the Group companies in respect of technical policy and development of IT and software of the Group.

Composition of the Committee:

- Vadim Kulik, Chairman of the Committee;

- Members of the Committee: Dmitry Eremeev, Maxim Krasnykh, Oscar Hartmann, Vladimir Kurlyandchik, Kirill Menshov, Yury Yartsev.

10 issues were considered by the Technical Policy Committee of the Supervisory Board in 2020.

The main issues considered by the Committee in 2020 and on which recommendations were given to the Supervisory Board related to building up the Exchange’s IT strategy and information security strategy, data center location configuration as well as establishing the IT Architecture Committee within the Group.

ASSESSMENT OF SUPERVISORY BOARD AND COMMITTEE PERFORMANCE

In accordance with the recommendations of the Corporate Governance Code and best international practices, Moscow Exchange assesses internally the performance of the Supervisory Board on an annual basis; once in three years, the Nomination and Remuneration Committee of the Supervisory Board regularly engages an external consultant for an independent assessment.

In 2020, a self-assessment of the Supervisory Board was performed internally which monitored the dynamics of changes in the activities of the Supervisory Board and the committees as well as determined the priority areas for the Board for the next corporate year. The assessment was performed via an online platform that ensured the anonymity for the Board members thereby improving the credibility of the system and giving the ability to express criticism where necessary. Eight directors participated in the self-assessment that allowed to achieve adequate representativeness of the answers.

Assessment results

Most of the aspects related to the Supervisory Board practices were highly rated by the members of the Board.

All participants of the assessment acknowledged that meetings of the Board are held in a right place with the enough number of directors participating and that meeting materials are provided using modern technologies. The members of the Supervisory Board were unanimously commended for complying with the confidentiality policy with regard to information that becomes available to the members of the Supervisory Board and for applying it appropriately. The Supervisory Board’s practices of monitoring the performance of the Chairman and members of the Executive Board, assessing their performance at least once a year, making decisions regarding senior management, including appointment and termination, remuneration and benefits, were generally recognised.

The assessment confirmed regular meetings with the company’s external independent auditor and receipt of its opinions, taking reasonable steps to ensure timely and regular provision of accurate reporting on the company’s financial results to the regulators in accordance with accepted accounting and financial reporting principles, and the involvement of the Supervisory Board in the selection of the external independent auditor. The participants were unanimous in their appreciation of the Supervisory Board’s practice of monitoring operational and financial performance, as well as of the approval of all relevant corporate policies and procedures, monitoring compliance with them and making material changes to the existing corporate policies. The active involvement of independent directors is confirmed - the independent directors are well informed and prepared for the Board meetings and actively participate in the meetings, while the number of independent directors is sufficient for the Supervisory Board to objectively review issues within its competence. The Chairman of the Supervisory Board also received overall high praise - he is well prepared for the meetings and actively participates in the meetings, as well as devotes time and energy to learning more about the company and its activities, and participates in company events outside the Supervisory Board meetings, but most importantly, adds quality and value to the Supervisory Board meetings.

Furthermore, the self-assessment highlighted the need to pay more attention to risk management issues, to increase the resources available to the company to develop and enhance the knowledge and skills of directors, to raise directors’ awareness of their colleagues’ skills and knowledge of the company on an ongoing basis, to increase their interaction with mid-level managers and to reduce the duration of Supervisory Board meetings.

CORPORATE SECRETARY

In accordance with a resolution of the Supervisory Board, the function of Corporate Secretary is performed by the Corporate Governance Department headed by its Director, administratively reporting to the Chairman of the Executive Board, and functionally reporting to the Chairman of the Supervisory Board.

Resolutions on appointment, dismissal, and remuneration of the Director of the Corporate Governance Department are adopted by the Supervisory Board, which ensures the necessary degree of independence of the work of the governing bodies.

Since October 2013 Alexander Kamensky has served as Director of the Corporate Governance Department.

Corporate Secretary of Moscow Exchange

Born in 1982 in Moscow.

In 2005, he graduated with honors from Lomonosov Moscow State University, Law Faculty, with a degree in Jurisprudence. He is also a graduate of the Leadership Programme at INSEAD Business School. In 2014, he received a Director Certificate from the UK’s Institute of Directors.

He was awarded the Director of the Year Prize by AID and RSPP in the Corporate Secretary category in 2015; the twelfth ARISTOS 2014 award in the Best Corporate Governance Director category; the Top 1000 Russian Managers 2017 award in the Best Corporate Governance Director category. In

Work experience:

- 2013 - present: Director of the Corporate Governance

Department – Corporate Secretary of PJSC Moscow Exchange; 2012–2013 : Head of the Corporate GovernanceCentre – Corporate Secretary of PJSC MDM Bank;2011–2012 : Manager for CorporateGovernance – Corporate Secretary of PJSC Enel Russia.

Number of shares held / equity interest in the Exchange: 8 shares / 0.00000035%.

Transactions involving shares of Moscow Exchange in 2020

Date | Purchase (in shares) | Sale (in shares) | Balance | Equity interest, % |

|---|---|---|---|---|

01 January 2020 | 5,005 | 0.00022 | ||

05 November 2020 | 300,000 | 305,005 | 0.013 | |

05 November 2020 | 237,367 | 67,638 | 0.003 | |

01 December 2020 | 67,630 | 8 | 0.00000035 |

He does not own any shares in the Exchange’s subsidiaries or affiliates. He has no family relations with any members of the governing bodies and/or supervisory bodies controlling the financial and business activities of the Exchange. He has been a member of the Council of the National Union of Corporate Secretaries since 10 October 2016.

FURTHER DEVELOPMENT OF CORPORATE GOVERNANCE

In 2020, the Supervisory Board defined the following main priorities on the basis of self-assessment:

- approval of Moscow Exchange Group’s target and cap risk appetite,

- definition of rules of interaction with CCP NCC,

- approval of metrics to track strategy implementation and a business plan based on the strategy.

In addition, the 2-year tasks were determined such as to identify a pool of successors for Supervisory Board members, a pool of management successors and to formalise the holding company’s governance system.

During 2020, the Supervisory Board approved Moscow Exchange’s risk appetite indicators and their thresholds for 2021, as well as the Methodology for determining benchmark indices for Moscow Exchange’s risk appetite in a new version, Moscow Exchange Anti-Corruption Policy, the

MOSCOW EXCHANGE’S CORPORATE GOVERNANCE CODE

In 2019, the Exchange’s Supervisory Board approved a new version of Moscow Exchange’s Corporate Governance Code.

The Code complies with Russian legislation and was developed taking into account principles and recommendations of the Bank of Russia’s Corporate Governance Code and the OECD’s Corporate Governance Principles, other principles of corporate governance, recommended by recognised international organisations; it complements the Exchange’s corporate governance system with procedures that comply with high standards of corporate governance.

The main purpose of the Code is to describe the corporate governance system currently applied on the Exchange to protect the rights and interests of its shareholders, enhance the efficiency of the activities of the Exchange, as well as improve the transparency and attractiveness of the Exchange for shareholders and consumers.

The Exchange’s Code describes the system, principles and practices of corporate governance of the company, risk management and internal control. It provides for principles designed to ensure the protection of legitimate rights and interests of shareholders and the equal treatment of all shareholders when they exercise their rights. Additionally, the Code contains the Exchange’s corporate social responsibility goals and principles, the principles of interaction with shareholders, service users and other stakeholders and the principles of corporate governance at Group companies.

A distinctive feature of the document is that it provides the background and mechanisms for the further improvement of the corporate governance system of the Exchange as well as that it contains development plans for the implementation of corporate governance principles. This sets not a declarative but a practical tone for the Code and allows the Exchange to continue reforming and improving corporate governance.

INFORMATION POLICY

The Exchange strives to ensure that its activities are as transparent as possible for shareholders, investors and other stakeholders. In June 2020, the Supervisory Board adopted the Exchange Information Policy. The document is available on the Exchange’s website: https://www.moex.com/s1358?utm_source=www.moex.com&utm_term=information%20policy.

The information policy is a body of rules that the Exchange (including members of its management bodies, officials and employees) adheres to when disclosing information and/or providing information to shareholders and other stakeholders.

The information policy provides additional opportunities for stakeholders to exercise their rights and interests and is also aimed at improving the Exchange’s information interaction with all stakeholders.

Methodology used by the Exchange to assess compliance with the corporate management principles set out in the Bank of Russia’s Corporate Governance Code

The recommendations of the Bank of Russia were applied as the methodology used by the Exchange to assess compliance with the corporate management principles set out in the Bank of Russia’s Corporate Management Code.

Among other things, the assessment analyzed the compliance of the Exchange’s corporate management practices and internal procedures with the principles and recommendations of the Bank of Russia’s Corporate Management Code.

The results of the assessment are contained in the Report on compliance with the principles and recommendations of the Corporate Management Code, which is a part of this Annual report.

Over the past years, the Exchange has been working to bring its corporate management practices in line with the Bank of Russia’s Corporate Management Code. The annual analysis of the results of the corporate management assessment shows a tendency to increase the number of principles and recommendations followed.

DIRECTORS’ LIABILITY INSURANCE

The liability of Moscow Exchange’s directors and officers (including independent directors), as members of the Company’s management bodies, is insured on annual basis. The purpose of this insurance is to provide compensation for potential damages caused by unintended negligent actions (or by their inaction) on the part of the insured individuals in the performance of their administrative activities.

Under the insurance contract concluded in 2020, the insurance premium is USD 400,000, and the insured amount is USD 50 mln (the total additional insured amount is USD 5 mln for independent directors). The insurer is Ingosstrakh.

The terms and conditions of the insurance contract, including the insurance coverage, are consistent with the best global insurance practices.

EXTERNAL AUDITOR

Auditor’s name: Deloitte & Touche CIS

INN: 7703097990

OGRN: 1027700425444

Address: 5 Lesnaya Street, 125047 Moscow

The auditor is the member of Self-Regulatory Organization Sodruzhestvo

The organization is located at: 21 Michurinsky Prospect, building 4, 119192 Moscow

Principal Number of Registration Entry: 12006020384.

Auditing Team:

- Andrey Shvetsov, Lead Auditor;

- Ekaterina Ponomarenko, Partner, Quality Control;

- Anna Naydunova, Senior Audit Manager;

- Natalia Kaprizina, Partner, Internal Control Audit;

- Ekaterina Shelkova, Manager, Internal Control Audit;

- Aleksei Chagovets, Director, Valuation;

- Willy Elizarov, Partner, Tax Audit;

- Eldana Nusipakinova, Manager, Tax Audit.

The fee for the audit of the annual accounting (financial) statements of Moscow Exchange and of the consolidated statements of Moscow Exchange Group for 2020, as well as the review of the consolidated statements for 6M 2020 was RUB 17,981 thousand, including VAT.

Deloitte and Touche CIS rendered no other services to PJSC Moscow Exchange in 2020 beyond audit services.

External auditor selection procedure

Moscow Exchange selects its auditors every three years, as stipulated by the Regulations on the Auditor Selection Commission. The number of audit years by one organization normally does not exceed six years, or two consecutive auditor selection periods. The best candidate is chosen by the Auditor Selection Commission.

The auditor selection process is based on a review of technical and price characteristics of the bids and the selection of those providing the best terms for the audit of the financial (accounting) statements of Moscow Exchange and Group companies.

Based on its review of the bids, the Auditor Selection Commission determines the winning bid and recommends the candidate to the Supervisory Board’s Audit Committee. In turn, the committee recommends that the Supervisory Board should propose to the General Meeting of Shareholders of the Exchange to approve the candidate as the auditor. The final decision on auditor selection is made by the Annual General Meeting of Shareholders.

REMUNERATION FOR MEMBERS OF THE SUPERVISORY BOARD

The Exchange’s remuneration system for Supervisory Board members is set by the Remuneration and Compensation Policy (the “Policy”) approved by the Supervisory Board in December 2016 and by the latest version of the Remuneration and Compensation Regulation (the “Regulation”) approved by the Annual General Meeting of Shareholders in April 2019.

The Nomination and Remuneration Committee actively participates in improvement of the remuneration system for Supervisory Board members, taking into account corporate governance best practice and the experience of other public companies and international exchanges. The Policy and the Regulation apply only to members of Moscow Exchange Supervisory Board. During the reporting year, no amendments were made to the Policy.

According to the Policy, remuneration paid to Supervisory Board members shall be sufficient to attract, retain and properly motivate individuals with the skills and qualifications necessary to work effectively on the Supervisory Board.

The Nomination and Remuneration Committee provides recommendations on remuneration of Supervisory Board members on the basis of an expert assessment of remuneration paid by Russian companies with similar capitalization and competitors of the Exchange, and also based on the results of external studies conducted at the initiative of the Nomination and Remuneration Committee.

The Policy and Regulation govern all types of payments, benefits, and privileges provided to Supervisory Board members and contain no other forms of short-term or long-term incentives of Supervisory Board members.

In order to ensure independent decision making, the remuneration of Supervisory Board members is not tied to the Exchange’s performance or share price and does not include an option program. Supervisory Board members enjoy no pension contributions, insurance programs (apart from the Supervisory Board member liability insurance and the conventional insurance associated with travelling to perform duties as a director or to participate in Supervisory Board activities), investment programs, or other benefits or privileges, unless specified in the Policy and Regulation. The Exchange does not provide loans to Supervisory Board members and does not enter into civil law contracts with them for the provision of services to the Exchange, also on non-market terms.

Remuneration for performing the duties of Supervisory Board member shall not be paid to state employees, employees of the Bank of Russia, employees and managers of the Exchange or its subsidiaries.

Remuneration of directors for performing their duties comprises basic and supplementary components.

The level of basic remuneration of a member of the Supervisory Board depends on whether such member is independent or not, and:

- for an independent member of the Supervisory Board, amounts to RUB 7.5 mln;

- for a non-independent member of the Supervisory Board, amounts to RUB 5 mln.

The following differentiated supplementary remuneration is paid to Supervisory Board members for performance of additional duties, requiring extra time and effort, of Chairman of the Supervisory Board, Deputy Chairman of the Supervisory Board, Chairman of a Supervisory Board Committee, or member of a Supervisory Board Committee, and:

- for the Chairman of the Supervisory Board, amounts to RUB 8.5 mln;

- for the Deputy Chairman of the Supervisory Board, amounts to RUB 3.5 mln;

- for the Chairman of a Supervisory Board Committee, amounts to RUB 3.75 mln;

- for a member of the Supervisory Board Committee, amounts to RUB 1.5 mln.

In order to ensure remuneration of Supervisory Board members corresponds to changing market demands until the next cycle of remuneration level review, the Regulation provides for adjustment of the level of remuneration of Supervisory Board members in line with the consumer price index at the end of the year in which the corresponding composition of the Supervisory Board was elected, and accrued starting from 1 January 2019.

When a member of the Supervisory Board performs the duties of Chairman and/or member of more than one Committees of the Supervisory Board, such member is paid remuneration for the chairmanship and/or membership in each such Committee.

By resolution of the General Meeting of Shareholders of the Exchange, members of the Supervisory Board may be paid supplementary remuneration for participation in conferences or forums held at the initiative or with the participation of the Exchange and aimed at improving the Exchange’s interaction with investors or financial market participants. The exact amount of the specified supplementary remuneration is determined taking into account the importance, duration and location of the event, and may not exceed RUB 400,000.

The amount of the basic and supplementary remuneration of a member of the Supervisory Board is fixed, reflects the expected time costs associated with performing duties of a member of the Supervisory Board, and is not tied to participation in each meeting of the Supervisory Board or Supervisory Board Committees (including unscheduled ones). However, the amount may be reduced by 25% or 50% if a member of the Supervisory Board attended less than 50% or 75% of in-person meetings of the Supervisory Board or Committees, respectively. If a member of the Supervisory Board took part in 1/3 or less of the total number of meetings of the Supervisory Board or in 1/4 or less of in-person meetings of the Supervisory Board, the General Meeting of Shareholders of the Exchange may decide not to pay remuneration to such member of the Supervisory Board.

In case of early termination of powers of a member of the Supervisory Board, the calculation of remuneration of such member is made pro-rate for the actual period of performance of his/her duties.

Apart from the remuneration for work on the Supervisory Board and Supervisory Board Committees, in accordance with the Exchange’s Policy, members of the Supervisory Board are reimbursed for travel expenses relating to participation in in-person meetings of the Supervisory Board or its Committees, General Meetings of Shareholders as well as events attended while performing duties of Supervisory Board members. In addition, members of the Supervisory Board who travel to attend meetings and other events held outside their place of residence are reimbursed for travel expenses.

In order to maintain the necessary professional level of Supervisory Board members, the Nomination and Remuneration Committee may recommend paying for professional training and refresher courses.

An exhaustive list of reimbursable expenses is established by the Regulation.

The Nomination and Remuneration Committee ensures that members of the Supervisory Board participate in oversight of the remuneration of Supervisory Board members.

The amount of remuneration paid in 2020 to MOEX Supervisory Board members for the performance of their duties in the period from the date of election in 2019 to the date of termination of their powers in 2020 (corporate year) is determined in accordance with the terms of the Regulation which were in effect until the Annual General Meeting of Shareholders held on 28 April 2020.

The resolution to pay remuneration to Supervisory Board members for the performance of their duties during their term of office, as well as to determine the amount of individual remuneration of each director elected on 25 April 2019, was adopted at the Annual General Meeting of Shareholders held on 28 April 2020.

The remuneration of members of the Supervisory Board of the Exchange was previously reviewed by the Nomination and Remuneration Committee as well as by the Supervisory Board.

2020 | 2019 | 2018 | ||||||

|---|---|---|---|---|---|---|---|---|

Basic remuneration | Supplementary remuneration | Total remuneration incl. indexation, FX revaluation and attendance | Reimbursement of expenses | Remuneration for work in governance bodies of subsidiaries | Total amount of all payments and compensation | Total amount of all payments and compensation | Total amount of all payments and compensation | |

Ilya BAKHTURIN | 5,000 | 1,500 | 6,697.6 | 6,697.60 | ||||

Paul Bodart | 7,500 | 3,000 | 9,901.93 | 5,667.20 | 15,569.13 | 5,820.00 | 5,301.67 | |

Mikhail BRATANOV | 7,500 | 6,750 | 14,683.2 | 5,048.96 | 19,732.16 | 10,867.123 | 3,500.00 | |

Oleg VIYUGIN | 7,500 | 11,500 | 19,577.6 | 5,048.96 | 24,626.56 | 17,800.00 | 14,101.2 | |

Andrey GOLIKOV | 5,000 | 12,500 | 18,032.0 | 8,076.00 | 26,108.00 | 20,029.00 | 17,944.4 | |

Maria GORDON | 7,500 | 6,750.0 | 14,683.2 | 42.77 | 14,725.97 | 8,331.80 | 8,019.5 | |

Valery GOREGLYAD | 0 | 0 | 0.0 | 0.00 | 0.00 | 0.00 | ||

Yury Denisov | 0 | 0 | 0.0 | 116.14 | 116.14 | 16,712.00 | 15,562.2 | |

Dmitry EREMEEV | 7,500 | 3,000.0 | 10,432.8 | 10,432.80 | ||||

Bella ZLATKIS | 5,000 | 0 | 5,152.0 | 6,903.68 | 12,055.68 | 8,750.00 | 8,750.00 | |

Alexander IZOSIMOV | 7,500 | 6,750 | 14,683.2 | 695.68 | 15,378.88 | 9,321.00 | 0.00 | |

Rainer RIESS | 7,500 | 5,250.0 | 14,637.63 | 56.16 | 14,693.79 | 10,214.3 | 14,591.4 | |

CHAIRMAN AND MEMBERS OF THE EXECUTIVE BOARD

The current activities of the Exchange are managed by the Chairman of the Executive Board and by the Executive Board, which is the collegial executive body of the Exchange.

The Executive Board is headed by the Chairman who manages its activities.

Information on the Chairman of the Executive Board

Born on 31 May 1970 in Moscow.

- In 1993, he graduated from the Moscow State Institute of International Relations with a qualification in International Economic Relations.

- He was elected to the post of Chairman of the Executive Board by the resolution of the Supervisory Board (Minutes No.19 dated 24 April 2019) for the period from 16 May 2019 to 12 May 2022.

- In

2003–2015, he was co-chair of the National Foreign Exchange Association. - In

2013–2020, he was a member of the Supervisory Board of Moscow Exchange. - He is a member of the Supervisory Boards of CCP NCC and NSD, as well as a member of the Executive Board of the Russian Union of Industrialists and Entrepreneurs.

He has no interest in the share capital/ordinary shares in Moscow Exchange.

He reported the following transactions involving shares in Moscow Exchange in 2020.

Date | Purchase (in shares) | Sale (in shares) | Balance | Equity interest, % |

|---|---|---|---|---|

06 November 2020 | 611,444 | 611,444 | 0.0268 | |

13 November 2020 | 250,000 | 361,444 | 0.0159 | |

16 November 2020 | 361,444 | 0 | 0 |

Information on Members of the Executive Board

Chief Information Officer (CIO)

Born on 18 March in 1975 in Chelyabinsk.

- He graduated from Lomonosov Moscow State University with a qualification in Computational Mathematics and Cybernetics.

- Prior to joining Moscow Exchange, Mr. Burilov served as vice president and IT director at SMP Bank. From 2013 to 2018, he was department director and a member of the Executive Board at Sberbank Technologies. From 2005 to 2013, he worked at Renaissance Capital.

- He began his professional IT career in 2001 at Deutsche Bank, where he created, developed and maintained an equity trading platform.

- In June 2020, Andrey Burilov was appointed Chief Information Officer and approved as a member of Moscow Exchange Executive Board. His term of office is from 9 June 2020 to 8 June 2023.

Length of service with the Exchange: since 2020.

He has no interest in the share capital of Moscow Exchange.

He reported no transactions involving shares of Moscow Exchange in 2020.

Chief Financial Officer (CFO)

Born on 28 October 1979 in Shuya, Ivanovo region.

- In 2003, he graduated from Lomonosov Moscow State University with a qualification in Economics.

- In 2007, he graduated from Columbia Business School with a degree of Master of Business Administration in Finance.

- From February 2014 to July 2016, he headed the Business Development & Performance Management Department of the Magnitogorsk Iron and Steel Works.

- In August 2017, he became an Advisor to Moscow Exchange. Since 2 October 2017, he has been a member of the Executive Board of Moscow Exchange. His term of office is from 2 October 2019 to 30 September 2021.

- Since 2018, he has been Chairman of the Board of Directors of MB Innovations.

Length of service with the Exchange: since 2017.

His interest in the share capital/ordinary shares of Moscow Exchange: 146,152 units/0.0064%.

He reported the following transactions involving shares in Moscow Exchange in 2020.

Date | Purchase (in shares) | Sale (in shares) | Balance | Equity interest, % |

|---|---|---|---|---|

26 June 2020 | 8,710 | 8,710 | 0.00038 | |

29 June 2020 | 1,290 | 10,000 | 0.00044 | |

05 November 2020 | 136,152 | 146,152 | 0.0064 |

Managing Director for Sales and Business Development

Born on 1 April 1974 in Moscow.

- In 1998, he graduated from the Finance Academy under the Government of the Russian Federation with a degree in Finance and Credit.

- From 2013 to 2016, he worked as the Managing Director of the Money Market. Since 22 July 2016, he has been a member of the Executive Board and the Managing Director of the Money and Derivatives Markets. His term of office is from 24 July 2018 to 21 July 2021.

- Currently, he is a member of the Board of Directors of MB Innovations LLC; Chairman of the Supervisory Board of the National Mercantile Exchange; member of the Board of Directors of the Kazakhstan Stock Exchange; member of the Council of the International Association of Commonwealth of Independent Countries; and member of the Board of Directors of the National Financial Association.

Length of service with the Exchange: since 2000.

His interest in the share capital/ordinary shares in Moscow Exchange: 148,189 units/ 0.0065%.

He reported the following transactions involving shares in Moscow Exchange in 2020.

Date | Purchase (in shares) | Sale (in shares) | Balance | Equity interest, % |

|---|---|---|---|---|

03 November 2020 | 148,189 | 148,189 | 0.0065 |

Managing Director for International Cooperation and Global Markets

Born on 28 July 1975 in Moscow.

- In 1997, he graduated from the Finance Academy under the Government of the Russian Federation, Institute of International Currency, Financial and Credit Affairs, World Economy.

- He has over 25 years’ experience in the banking sector.

- From 2003 to 2009, he was the first vice president in charge of the treasury at Gazprombank, where he was responsible for the bank’s proprietary and client transactions on the financial markets.

- From 2011 to 2020, he was Chairman of the Management Board at the National Clearing Center (NCC), part of Moscow Exchange Group.

- Since 2011, he has been a member of the Board of Directors at self-regulating organization National Financial Association and member of the Association of Banks of Russia (Association Russia).

- On 18 June 2020, he was appointed Managing Director for International Cooperation and Global Markets and approved as a member of the Executive Board of Moscow Exchange.

- His term of office is from 18 June 2020 to 15 June 2023.

He has no interest in the share capital of Moscow Exchange.

He reported the following transactions involving shares in Moscow Exchange in 2020.

Date | Purchase (in shares) | Sale (in shares) | Balance | Equity interest, % |

|---|---|---|---|---|

03 November 2020 | 296,780 | 296,780 | 0.013 | |

05 November 2020 | 296,780 | 0 | 0 |

Chief Operating Officer (COO)

Born on 1 September 1975 in Orekhovo-Zuevo, Moscow region.

- In 1998, he graduated from the Stankin Moscow State Technology University with a degree in Automation and Control.

- He holds a PhD in Engineering Sciences.

- In 2016, he graduated from the Moscow School of Management SKOLKOVO with an Executive MBA (Master of Business Administration) degree.

- Since 1 April 2013, he has been a member of the Executive Board of Moscow Exchange. His term of office is from 3 April 2020 to 31 March 2022.

Length of service with the Exchange: since 1998.

Number of shares held / equity interest in the Exchange: 130,426 units/0.0057%.

He reported the following transactions involving shares in Moscow Exchange in 2020.

Date | Purchase (in shares) | Sale (in shares) | Balance | Equity interest, % |

|---|---|---|---|---|

16.11.2020 | 17,258 | 0,00076 | ||

17.11.2020 | 113,168 | 130,426 | 0,0057 |

REMUNERATION OF EXECUTIVE BOARD MEMBERS

Remuneration of members of the Executive Board is regulated by the Remuneration and Compensation Policy for Members of the Executive Board, approved by the Supervisory Board in 2016. The Policy sets out principles for remuneration, and establishes procedures for determining remuneration levels as well as types of payments, incentives and privileges payable to members of the Executive Board.

The Policy is based on the following key principles:

- Involvement and retention of a professional and effective team consisting of Executive Board members able to implement the Exchange’s strategy and other priorities and increase shareholder value;

- Competitive remuneration at a level sufficient to engage, motivate and retain competent and qualified Executive Board members;

- Maintaining an optimal balance between the Exchange’s business performance and the personal contribution of an Executive Board member in determining remuneration levels.

Executive Board members’ remuneration consists of a fixed salary and a variable component. The variable component comprises a significant portion of annual remuneration, and includes short- and long-term components. Short-term variable remuneration takes the form of an annual bonus based on the Exchange’s results and the individual contribution of the Executive Board member to those results. Long-term variable remuneration is shares-based and is established by the Long-Term Incentive Programme.

The short-term variable component is determined by an annual approval of key performance indicators including corporate and individual key efficiency indicators. In 2020, the ratio of corporate and individual indicators was 40:60; in 2021, the ratio is set at 50:50 to incentivize the achievement of corporate indicators. Furthermore, from 2020, for the Chairman of the Executive Board, corporate key performance indicators are also his individual ones, i.e. they account for almost 100%.

To promote personal responsibility, the Supervisory Board applies a delayed bonus plan taking into account the contribution of Executive Board members to the Exchange’s financial and other results, including the possibility of reducing or cancelling part of the delayed bonus if no positive results are obtained in the relevant area. Payment of 60% of the approved bonus amount for 2020 will be made in 2021, and 40% will be paid with a delay in equal portions within one and two calendar years (20% within one calendar year, and 20% within two calendar years) based on the relevant decisions of the Exchange’s Supervisory Board. This procedure makes it possible to account for risks created by decisions made by Executive Board members.

The stock-based Long-Term Incentive Programme, as approved by the Supervisory Board, is designed to boost Executive Board members’ motivation and responsibility, align their interests with those of shareholders and connect remuneration with long-term performance results. From 2 July 2020, a new programme has been in place, under which the right to obtain shares becomes effective in stages: over periods of three, four and five years after the programme start, provided that the contracts of the members remain in force.

Compensation paid in the event of early termination of the authority of a member of the Management Board (following a Supervisory Board decision on terminating a contract), and assuming no unethical practices on the part of the member, is capped at the amount of the fixed annual bonus component. If a contract is terminated for other reasons, compensation is paid only in cases and amounts provided for by the Labor Code of the Russian Federation.

Specific remuneration due to executive body members, conditions and procedure for paying such remuneration, as well as conditions for early termination of agreements, including discharge allowances, compensations and other payments in any form exceeding those established by law, and conditions for their provision are considered and approved by the Supervisory Board based on recommendations made by the Assignment and Remuneration Committee, which reports to the Supervisory Board.

The Supervisory Board, supported by the Assignment and Remuneration Committee, ensures oversight of implementation of the Remuneration Policy, and can amend it as necessary.

Total remuneration due to a member of the Board, including the ratio of the remuneration components, is assessed by the Assignment and Remuneration Committee to ensure compliance with remuneration levels at comparable companies, based on a remuneration study from a leading consulting company.

Executive Board members are not paid for their work in management bodies of other Group companies.

The Exchange does not lend to members of management bodies and does not enter into civil law contracts with them for the provision of services to the Exchange, including any contracts on non-market terms.

Amount | |

|---|---|

Remuneration specifically paid for participating in work of the Management Board | 0.00 |

Salary/wage | 143,641.39 |

Bonus | 131,197.00 |

Commission fees | 0.00 |

Remuneration for participating in work of subsidiary’s management body | 0.00 |

Expense reimbursement | 0.00 |

Other types of remuneration | 18,459.92 |

TOTAL | 293,298.30 |

INTERNAL CONTROL SYSTEM

MOEX’s internal control system ensures that the Exchange’s licensed activities are conducted in accordance with Russian legislation and regulation, the rules of organised trading, and the Exchange’s own constituent and internal documents.

Internal control activities aim to identify, analyze, assess and monitor the risk of loss and/or other adverse consequences of both MOEX’s operational activities and measures taken by the Bank of Russian and other regulatory bodies (“compliance risk”), and to manage any such risks.

Within this framework, the Exchange’s internal control system is based on the COSO concept and utilizes a Three Lines of Defense model, which distributes risk management and internal control obligations among MOEX’s governing bodies, control and coordination units, and the internal audit unit.

The First Line of Defense is represented by employees of the Exchange’s business and operational units of the Exchange, whose key functions are to identify, assess and manage the risks inherent in MOEX’s daily activities, and to develop and implement policies and procedures governing existing business processes.

The Second Line of defense is represented by the Operational Risk, Informational Security and Business Continuity Department, the Internal Control and Compliance Department, Internal Control Service, Security Department and Legal Department as well as certain employees and divisions of the Financial Division, which carry out continuous risk monitoring and management also of the following areas:

- ensuring information security, including protecting the Exchange’s interests in the information sphere;